I was reading an extract from an article written by Roger L. Martin in the Harvard Business Review about Strategic Planning. It is well worth a read because he explores the fact that business managers do not really get strategic planning. He suggests that when a business does decide to conduct some form of strategic planning, it tends to be an extension of a business planning exercise, all about profit and loss cash flow statement, marketing plans, sales projections and cost reductions. These analytics are generally short-term, because, as individuals and as business managers we do not have the capability to predict what the world will be like in 5 years time based on the information we have today. As an economist, I would not be game to predict with 100% confidence what will happen in a couple of months with the tools I have at my disposal, let alone what will happen in 10 to 20 years.

I would provide through economic modelling a range of potential scenarios based on historical data analytics and correlation between business projections and historical economic activity.

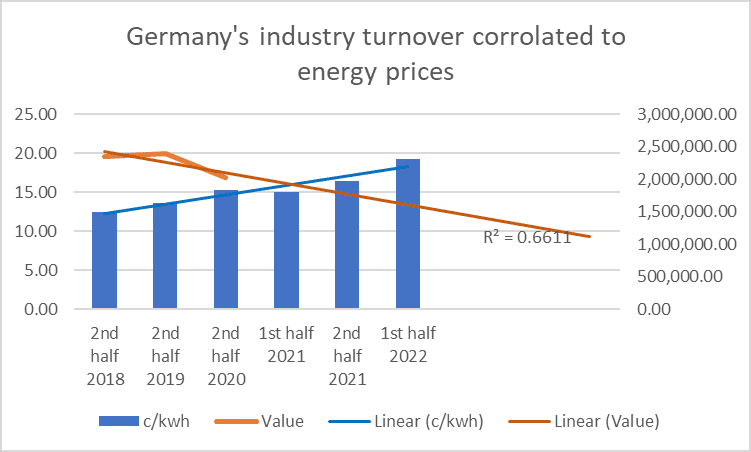

However, this analysis does not allow for guaranteed business planned outcomes, as it is based on historical variables. The most important variable is the customer and customer demand. In all of the cases I have been involved with, whether as a business analyst or business owner, demand variables are the sticking point in predicting the future. If customer demand falls, business inventory stagnates and revenue falls. This is a basic supply and demand analysis. I will use as an example industry demand for energy as the price increases in the chart below (I know that my economic colleagues will question the correlation integrity due to the short data timeline; however, recent, up-to-date information on industry activity in Germany is already indicating industry exits due to cost of energy).

This analysis is all about the price of supply (cost of energy) and inflation-driven input price (materials and labour) and the corresponding demand (business exit or import replacement), think demand by consumers of power (manufacturers) and end users (consumers of product and services).

As managers, we have to think beyond the ordinary business cycle in the decision-making process. This means that our profit and loss and cashflow spreadsheets are of no benefit in strategic planning because a sudden disruption such as wars, embargos, or pandemics will play havoc with our forward budgets, and cannot be forecast and factored into a spreadsheet. We can do a scenario analysis that will, to some extent address the issue. However, the problem is that we do not have a crystal ball that can predict the future with any accuracy, and the impact that a change in economic activity will have on business margins. This is further exacerbated as the forward horizon gets pushed further out into the future.

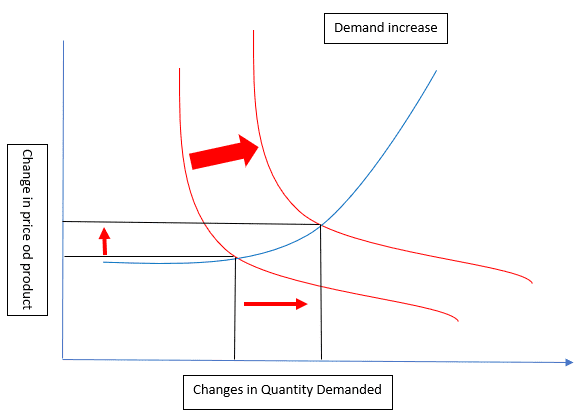

To emphasise the point and clarify how supply and demand work, the charts below provide an outline of what a shift in demand or supply will do to the price. In figure 1, we have the fossil fuel examples where due to restrictions in the supply of gas and some economies shutting down base load energy supply (coal and nuclear) we have a situation where the supply of gas takes time to develop, and demand will be immediate as we have seen with gas demand in Europe. Therefore, the price has to increase as noted in the chart in Figure 1

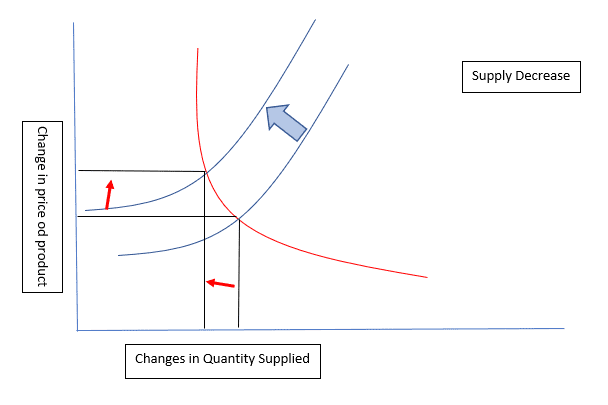

In Figure 2, we also have the gas supply reduction situation where Russia restricted the supply of gas to Europe. And as you can see, the leftward movement of the supply line causes an increase in price.

When products such as gas have a combined demand increase and supply limitation, an economic and social catastrophe is possible.

This is my point about strategic planning, we should not focus on business planning as a strategic tool by just focusing on spreadsheets and forward sales projections. We should be focusing on the methodology we use to analyse future customer demand and define how we can use this knowledge to improve business outcomes, both for business profit and for customer value. A recent good example is in an article published in the Courier Mail on the weekend, where it was stated that the BAC would spend $5 billion on upgrades to meet growing demand (current traffic 24 million by 2050, 50 million). My question is where does this statistic come from? The world is heading for a liquid fuel drought if the anti-fossil fuel has its way and at this stage, there is no commercially feasible replacement for avgas. This will price ordinary individuals out of the market and significantly reduce demand, please note the diagrams.

In summary, we need to remember that strategic planning is all about being prepared, and instead of looking at spreadsheets and sales projections, we need to start looking at how we can assess future customer demand and plan strategically to meet this demand. Past examples such as Blackberry, Kodak, and Nokia are good reasons why we need to change our planning strategy

The insights in this article are very valuable. The author’s approach to the topic was engaging and informative. I’m curious to hear different perspectives on this. What do you think?

I enjoyed the humor in this piece! For more, visit: FIND OUT MORE. Let’s chat about it!